Loans

Review Skye Bank

Benefit from a diverse selection of loan alternatives and compelling interest rates, allowing you to assume authority over your financial destiny.

Advertisement

Today we’re going to talk about a topic that many people have doubts about: bank loans. When money is tight, sometimes it’s necessary to resort to a loan to pay the bills or fulfill a dream, such as taking a trip or buying a new car. But before signing the contract with the bank, it’s important to understand how loans work.

First, you need to choose the type of loan that best fits your needs. There are personal loans, payroll loans, loans with collateral such as property or vehicle, among others. Each has its own characteristics and interest rates, so it’s important to compare options before choosing.

Another important thing to know is that a loan is not free money! You will have to pay interest on the borrowed amount, meaning you will return more money than you borrowed. Therefore, it’s important to choose a reasonable interest rate that fits your budget.

Oh, and don’t forget to read all the clauses of the contract carefully before signing. Pay attention to payment conditions, deadlines, late fees, among other details.

But if you really need money, a loan can be a good solution. Just don’t spend the money without thinking and end up getting even more into debt, okay? Now let’s find out a little more about Skye Bank and what types of loans it offers to its customers. Let’s go!

What to consider before choosing a bank to apply for a loan?

Did you know that there are some things you can consider before applying for a loan? Well, we can help you with that. When choosing a bank to apply for a loan, you need to first analyze the interest rate. This is one of the main factors you should consider when applying for a loan. It is very important to compare the interest rates that different banks offer, in order to choose the option that offers the lowest interest rate.

However, in addition to the interest rate, many banks also charge fees to process the loan. It is important to note that these fees may include origination fees, credit assessment fees, among others. So, you should understand all the fees that may be associated with the loan before choosing a bank.

The repayment period is also important! That is, the period of time in which you will have to pay the loan back. Therefore, you should choose a repayment period that is suitable for your budget and that you can comfortably pay.

Now, one of the factors that weigh heavily on the customers’ decision is the bank’s reputation. That is, before choosing a bank to apply for a loan, it is important to do some research on the bank, and we can help you with that! Check online reviews and reviews from previous customers, as well as the bank’s reputation with regulators.

On the other hand, choose a bank that offers simple and easy-to-understand processes for applying for and repaying the loan. Make sure the bank offers online banking services or mobile apps that make managing your loan easier. And finally, the payment conditions. That is, find out if the bank offers flexible payment options, such as the ability to make early payments or change the repayment period if necessary.

By taking these factors into consideration, you can choose a bank that offers the best loan conditions to meet your financial needs.

Skye Bank

If you are looking for a loan that meets your needs and objectives, you have come to the right place: Skye Bank!

Trending Topics

Sterling Ultra Classic credit card: Learn More

Meet the Ultra Classic credit card! With it you have up to 45 days to pay your invoice, in addition to other irresistible benefits!

Keep ReadingYou may also like

Union Bank of Nigeria: Apply now!

Maximize your financial potential with Union Bank of Nigeria. With flexible loan options, innovative banking services, and expert support.

Keep Reading

Apply Keystone Bank

Discover a better way to manage your finances with Keystone Bank. With flexible repayment options, competitive interest rates.

Keep Reading

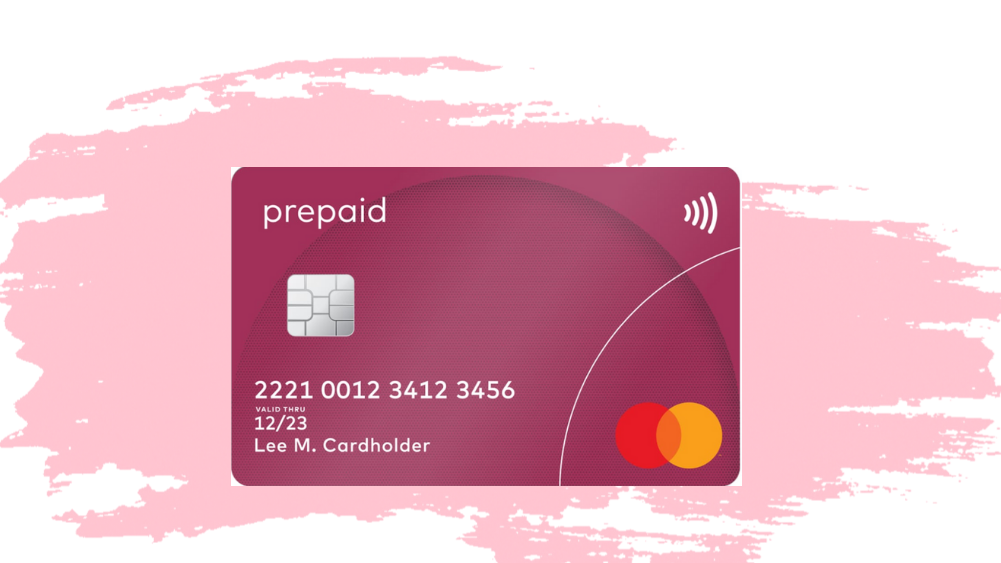

Access Bank Mastercard Prepaid Basic: Apply now!

Enjoy worldwide acceptance with the Access Bank Mastercard Prepaid Basic. Add money anytime, anywhere. See more now!

Keep Reading