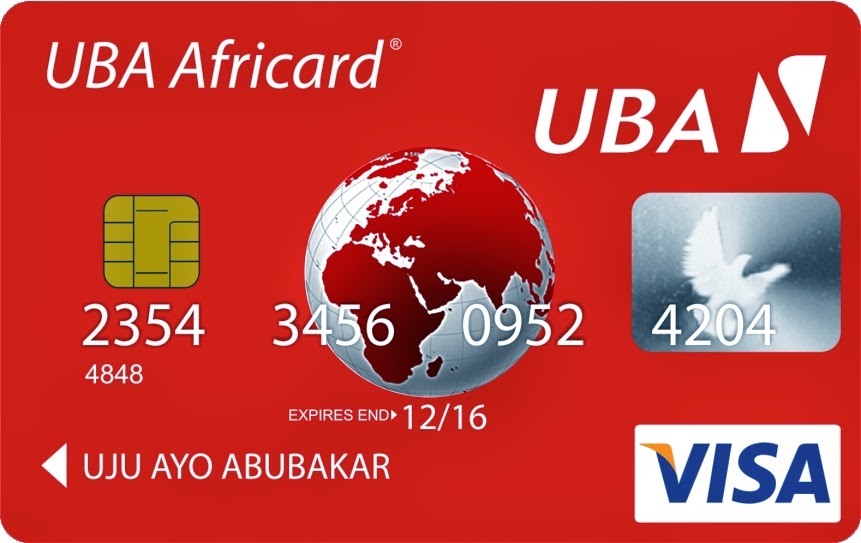

Credit Card

U-Advance Credit Card Ubagroup: Apply now!

Transform the way you bank with the U-Advance Credit Card from UBA Group. With innovative features and unparalleled benefits, you'll never want to go back to traditional banking.

Advertisement

U-Advance Credit Card Ubagroup

If you’re here it’s because you’re interested in the U-Advance Credit Card, right? But did you know that this card is a premium card. It’s great, right? Therefore, we will tell you a little more about what are the biggest differences found between traditional cards and premium cards.

It is worth noting that credit cards in general and in themselves are already a convenient way to handle your expenses and finances, but there are many options available, including traditional cards and premium cards.

In this way, both types of card have their own advantages and disadvantages. So it’s important to carefully consider which type is best for you. And for that, we’ll tell you the main differences between these two types of card.

Differences between traditional and premium card

First, traditional cards are generally more affordable and ideal for those just starting to build or improve their credit history. They usually have a lower interest rate and offer fewer features and benefits, but they still allow you to shop and pay your bills. Generally these are the cards most used by the general population.

However, premium cards, on the other hand, are meant for more advanced users and have a host of additional features and benefits. They usually have higher interest rates, but they also offer more generous rewards like bonus airline tickets, hotel nights, restaurant discounts, and more. In addition, many premium cards also offer travel insurance coverage, purchase protection, and even price protection.

Another difference between traditional and premium cards is the level of credit requirements. Premium cards generally require an excellent credit history or a high income, while traditional cards are more affordable for those with an average or lower credit history.

However, when deciding between a traditional card and a premium card, it’s important to consider your financial needs and lifestyle. If you are just starting to build your credit history or don’t use your credit card often, a traditional credit card may be the right choice for you.

However, if you are a frequent traveler or enjoy making high-value purchases, a premium card might be a more sensible choice as it offers additional benefits and better rewards.

In short, traditional and premium cards offer different advantages and the right choice depends on your financial needs and lifestyle. It is important to compare the available options and carefully consider which.

Requirements to apply for the U-Advance Credit Card:

If you are interested in applying for the U-Advance Credit Card, you must be sure that you meet the necessary requirements. So, some of the requirements are:

- Credit history: You need to have a healthy credit history, with no late bills or recent delinquencies. So make sure you keep this data in agreement.

- Income: The U-Advance Credit Card may require you to have a minimum income to qualify. It is important to check income requirements before applying for the card.

- Identification: You will need to provide personal information, such as your name, address and date of birth, to apply for the card. In addition, you will need to provide a valid form of identification, such as a passport or driver’s license.

- Financial Information: You will need to provide financial information, such as your employment and income, to help the financial institution evaluate your application.

- Proof of Address: You will need to provide recent proof of address, such as a water or electricity bill, to prove your current address.

- Finally, you should check for any other U-Advance Credit Card specific requirements before applying for the card. Be sure to read all information and terms of use before placing your order.

In short, if you have a healthy credit history, a stable income and the necessary personal and financial information, you may be eligible to apply for a U-Advance Credit Card. Therefore, as the card offers many advantages, it will certainly be the ideal option for your financial health and for what you want.

Now we are going to show you some of the advantages that this card offers, mainly because it is a premium card, which offers more benefits than the traditional cards that we commonly find out there.

Trending Topics

Recommendation – Paylater

The platform provides quick and easy access to credit through its mobile app. Please see more about this right now.

Keep ReadingYou may also like

Review Heritage Bank

Empower your financial future with a loan from Heritage Bank. From personal loans to business loans, we have the loan options you need.

Keep Reading

Unity Bank: Apply now!

The bank's mobile app and digital banking solutions make it easy to stay on top of your finances, no matter where you are.

Keep Reading